The accountancy sector is evolving. Improvements in technology and the use of automation software, as well as general changes to the world of work – increased hybrid/remote working models and changes to the way we communicate – mean that accounting technicians need different knowledge, skills and behaviours to be effective in the workplace. So how can accountancy firms and teams best use the training options on offer to develop competent accounting technicians and enable them to become the accountants of the future?

Accountancy Training

There are two main pathways of accountancy training that employers use for their junior accounting technicians: stand-alone courses (e.g. level 2, 3 and 4 AAT qualifications), and accounting apprenticeships, which incorporate the knowledge content and qualifications provided by professional bodies such as AAT, within a structured programme of wider on and off-the-job training.

We surveyed managers of accounting teams and HR leads within accounting firms to see which route they preferred. 83% responded that apprenticeships produce a more competent accounting technician than stand-alone courses, with the other 17% responding that they weren’t sure.

There are two distinct advantages that accountancy apprenticeships provide over stand-alone courses. First, a wider and potentially more relevant knowledge-base, and second, development of critical skills and behaviours that accounting technicians can effectively implement, now and into the future

Knowledge, Skills and Behaviours

There is obviously an important core of knowledge that accountants need in their role, and professional bodies such as AAT and ACCA aim to develop their qualifications to meet these needs.

Every four to five years, the AAT revises its qualifications to try to reflect the needs of the accountancy sector as well as the wider business environment. In September, they will be releasing Q2022, their revised accounting and bookkeeping qualifications at levels 2, 3 and 4. In our survey, only 41% of respondents were very or somewhat aware of the changes that AAT are making to their qualifications.

- Communication

- Technology

- Sustainability

- Ethics

Most of the changes involve some streamlining of the assessments and units throughout the qualifications (there is a summary of the changes at the end of this article). However, they have also introduced four new knowledge themes across the three levels:

Whilst the development of course content in these areas by professional bodies such as AAT and ACCA is welcome, it remains arguable whether the qualifications provide the breadth and depth of knowledge that is required by accounting technicians in 2022 and beyond. And, even more importantly, they don’t allow for the structured development of skills and behaviours that complement this knowledge, and ensure that it is implemented effectively in the workplace.

“The development of communication skills is of paramount importance for the a junior accountant. Being able to effectively communicate to people on all levels from a CEO to the filing clerk is an essential skill to be effective in their role. This level of confidence is largely gained from professional training and on the job experience.”

Pete Edwards ACA, FCCA

Director, Warr & Co Chartered Accountants

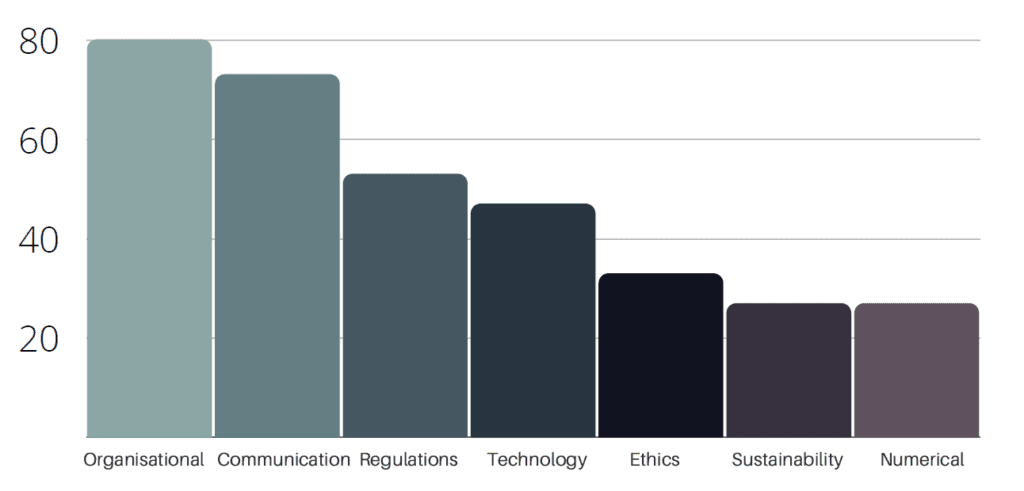

AAT’s four new knowledge themes – communication, technology, ethics and sustainability – were all identified as important by some or most of the respondents. However, organisational/planning skills and knowledge about regulations/compliance were also classified as critical by many.

Accountancy apprenticeships cover topics – including the development of knowledge, skills and behaviours – which are under-developed in many stand-alone accounting courses. There are apprenticeship modules covering the key components of organisational/planning skills, communication, and regulations, for example, across the three levels, beyond the knowledge-based AAT units:

- Communication, teamwork, and customer focus at level 2

- Regulations and legislation, self-organisation and time management, and building relationships at level 3

- Relevant regulations, communication, report writing, and working in teams at level 4

as well as a range of other topics useful to any individual in a junior role, including self-development, embracing change and continuous improvement.

In addition, learning about communication, technology, ethics or sustainability in a classroom or from reading materials, will never have the same impact as developing, applying and honing these skills in the real world of work. Throughout the apprenticeship, the apprentice is able to focus on the soft skills – such as communication and planning – that accounting employers have identified as essential, to actively seek out experiences which will enhance this skillset, and to reflect on these experiences and what they have learnt which can then be applied in future scenarios.

“Accountancy isn’t all about theory. Apprenticeship training gives real, on the job scenarios, far more than what is taught in a classroom. Blending both theory and on the job training is the perfect mix to the start of being an all rounded junior.”

Jason Kings, Director Ascendis Business Services Ltd

Other Benefits

Apprenticeships also provide other benefits to accountancy teams and practices that can’t necessarily be realised through stand-alone courses. Apprenticeships have been proven in government studies to increase productivity, improve the quality of products and services, decrease staff turnover, and improve staff commitment and loyalty.

Apprenticeships can also often be a very cost-effective training option for businesses. Larger employers (with a payroll in excess of £3million) have a dedicated apprenticeship levy pot specifically assigned to paying for apprenticeship training, whilst smaller employers are only required to pay a maximum of 5% of any apprenticeship training costs, with the government funding the remaining 95%.

In comparison to AAT stand-alone courses, accounting apprenticeships simply provide more content, including the development of behaviours and skills, alongside knowledge, for less financial outlay.

Maximising the Benefits of Apprenticeship Training

For employers who can recognise the benefits that apprenticeships offer, there are many strategies that can be used to help the individual and the organisation get the most out of the training.

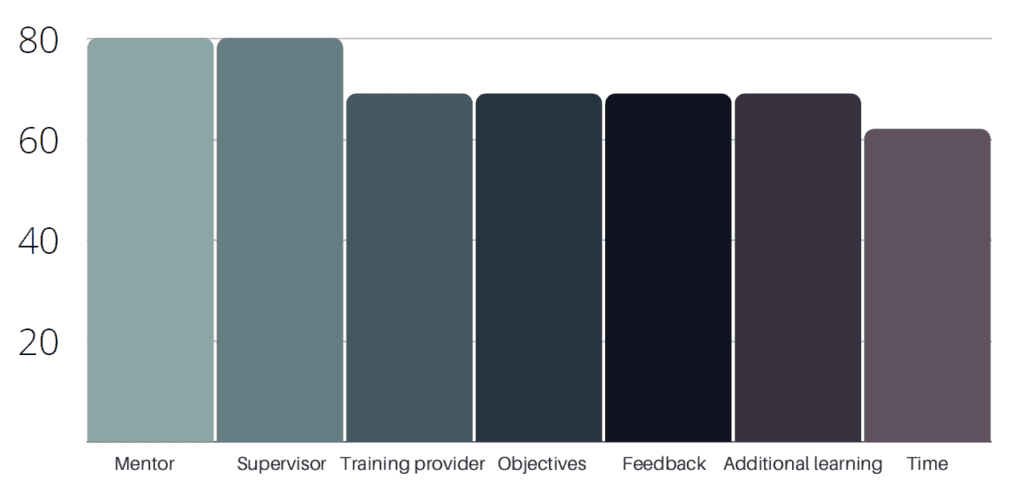

We asked employers who had engaged with apprenticeship training what strategies they had found most useful. The highest responses (81%) were providing a mentor and making sure the apprentice has an effective line manager/supervisor. Using a good training provider, setting clear goals and objectives, providing regular feedback on progress and giving the apprentice additional learning opportunities were also identified as important by 69% of respondents. Finally, giving enough time for off-the-job training was rated as important by 62%.

Supervisors: Line managing an apprentice, particularly where it is someone new to a professional work environment, can require a slightly different approach to managing other staff members. Line managers should ensure they are clear on wider workplace expectations (including things like dress standards, personal mobile usage etc.), as well as the objectives within the role itself. Apprentices need lots of feedback, which should be given regularly on an informal basis, alongside more structured and formal progress reviews. Supervisors should also be prepared to give pastoral support; anxieties and a lack of confidence can prevent an apprentice reaching their full potential, as much as a lack of skill or knowledge.

Mentors: Apprentices can benefit greatly from having a mentor in the workplace, who can provide additional guidance and support outside of the line management structure. A mentor should be someone in a more senior role within the same team or a different area of the business. The mentor should be a good listener, able to build confidence and trust, and genuinely interested in the development, goals and ambitions of the mentee. Employees who have themselves undertaken apprenticeship training can often make the most effective mentors.

Objectives: Setting clear goals and objectives for an apprentice is paramount to successful outcomes. They need to know what tasks they are expected to carry out, as well as standards and timeframes. Being clear from the beginning helps to keep the apprentice on track, and allows line managers to identify any issues or areas for further development as early as possible.

The Future Accountant

The future accountant will need a highly developed set of skills, knowledge and behaviours, all of which can be effectively nurtured through the apprenticeship pathway. In addition to being highly responsive to the changing needs of industry, individual apprenticeship training can also be tailored to the needs of specific employers. With so many benefits beyond stand-alone courses, apprenticeships clearly have a key role to play in the development of accounting technicians, to support more senior members of staff in the business and to become, in time, managers and leaders within accounting businesses.

A summary of the changes to AAT’s qualifications at levels 2, 3 and 4

- Repeated syllabus content between levels has been removed

- There are fewer assessments per level

- Level 2 Accounting Software, level 3 and level 4 Synoptic Assessments have been removed (for non-apprentices)

- New units have been added at level 2: The Business Environment, and level 3: Business Awareness

- At level 3, Bookkeeping and Financial Accounts Preparation have been combined into one unit: Financial Accounting: Preparing Financial Statements (FAPS)

- At level 4, Budgeting and Decision & Control have been combined into one unit: Advanced Management Accounting (AMAC)

- The Level 2 and 3 Bookkeeping qualifications will be graded as pass, merit or distinction.